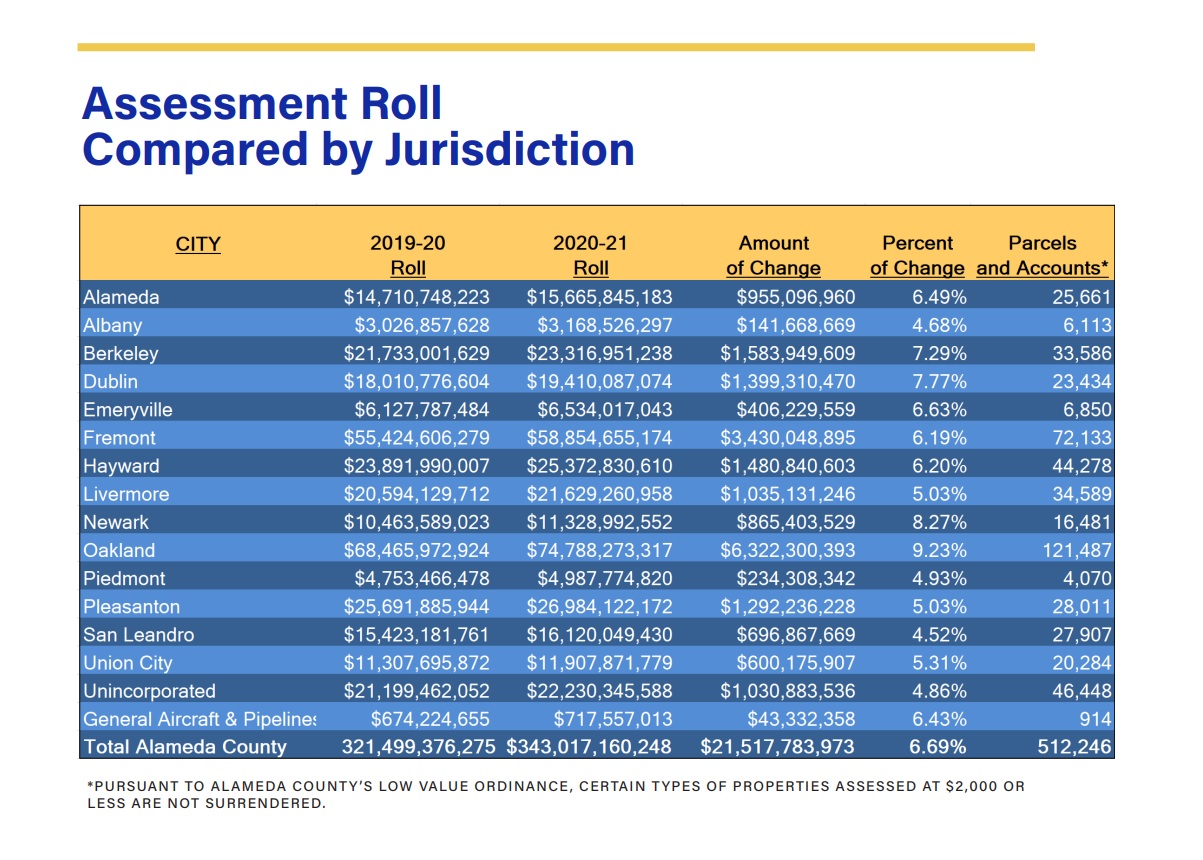

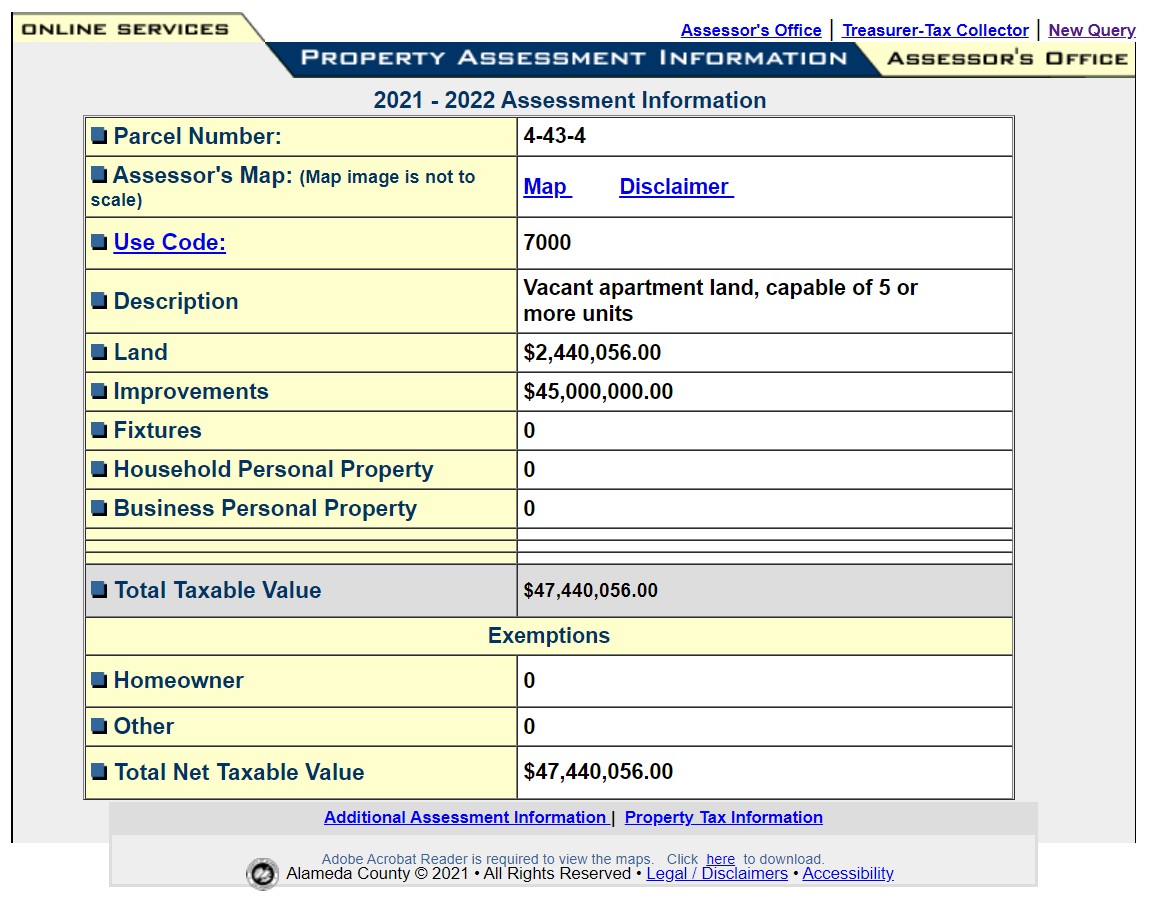

alameda county property tax 2021

Being mailed this month by Alameda County Treasurer and Tax Collector Henry C. This generally occurs Sunday.

Acgov Org Alameda County Government

Many vessel owners will see an increase in their 2022 property tax valuations.

. OTICE OF N SALE Page 2 of 3 pages. This is a California Counties and BOE website. Alameda County Treasurer-Tax Collector.

Dear Alameda County Residents. Tax Rate Areas Alameda County 2022. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the.

A message from Henry C. The system may be temporarily unavailable due to system maintenance and nightly processing. DUE FOR THE FISCAL YEAR 2021-2022.

Claim for transfer of base year value to replacement. The County of Alameda explicitly disclaims any representation and warranties including without limitation the implied warranties of merchantability and fitness for a particular purpose. Levy the Alameda County Treasurer-Tax Collector regarding the benefits of paying your Property Tax using the Alameda County E-Check System.

Alameda County Apportionment and Allocation of Property Tax Revenues -1- Audit Report The State Controllers Office SCO audited Alameda Countys process for apportioning and. 1221 Oak Street Room 131 Oakland CA 94612. Claim for reassessment exclusion fortransfer between parent and child.

1221 Oak St Rm 145. The valuation factors calculated by the State Board of. Many vessel owners will see an increase in their 2022 property tax valuations.

The Treasurer-Tax Collector TTC does not conduct in. The valuation factors calculated by the State Board of Equalization and. Only property tax related forms are.

For alameda county boe-19-b. ALAMEDA COUNTY SECURED ROLL PROPERTY TAXES. California property tax laws provide two alternatives by which the Homeowners Exemption up to a maximum of 7000 of assessed value may be granted.

The e-Forms Site provides specific and limited support to the filing of California property tax information. CHIEF TAX DEPUTY OFFICE OF CLERK MASTER HAMILTON COUNTY 423 209-6606 1 WHAT CLERK MASTER. Offering the property at public auction achieves.

Lookup or pay delinquent prior year taxes for or earlier. The valuation factors calculated by the State Board of Equalization and. Many vessel owners will see an increase in their 2022 property tax valuations.

The primary purpose of a tax sale is to collect taxes that have not been paid by the property owner for at least five years. Dear Alameda County Residents. The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900.

Dear Alameda County Residents. BOE-266 - REV13 5-20 for 2021 CLAIM FOR HOMEOWNERS PROPERTY TAX EXEMPTION. Alameda County collects on average 068 of a propertys.

Prop 19 Explained Are You Losing Winning Or Just Plain Confused

Newballpark On Twitter Step 1 Buy Out Alameda County S Share Of Coliseum Step 2 Convince Alameda County To Contribute Property Taxes To Howard Terminal Step 3 Buy Out City S Share Of Coliseum

Alameda County California Ballot Measures Ballotpedia

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Adu Summit 2021 How Adu And Prop 19 Will Affect Your Property Tax County Assessors Youtube

Alameda County Ca Property Tax Search And Records Propertyshark

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Home Treasurer Tax Collector Alameda County

Understanding California S Property Taxes

Transfer Tax Alameda County California Who Pays What

Property Tax Collection Treasurer Tax Collector Alameda County

Alameda County Ca Property Tax Search And Records Propertyshark

Alameda County Resource Conservation District Acrcd A Partnership Between Acrcd And Usda Natural Resources Conservation Service Nrcs

Meet The Assessor Alameda County Assessor

Berkeley For Assessment Tax Equity Seeking A Remedy For Systemic Inequitable Taxation Levied On Berkeley Property Owners